This course in economics is designed to optimize outcomes for friends and family during the present collapse of the US Dollar.

Part 1 – Purpose:

Part 2 – Currency vs Money

Money and currency are different. Currency printers would like you to believe they are the same as they’ve always been. Money is immune to inflation because silver and gold are worth what they are worth. Currency is a poor store of value because it’s fundamental value has been diluted by about 1000:1 since 1913.

The most recent 5:1 inflation that’s baked in makes it looks like the economy is growing instead of collapsing. As these newly printed dollars enter competition for a diminishing pool of goods and services, prices go up – but:

Y’all ain’t seen nothin yet.

Part 3 – The Meltdown Game

This is a high-level overview of how the US Dollar is on the meltdown path like all other fiat currencies before. The endpoint will render promises that depend on future money worthless. This includes Social Security, Retirement Benefits, Bank Deposits, and even cash.

Anyone who gambles the future value of these assets will enable them to hold on to their debt-secured property is gambling hard. Once currency fails, the economy will seize. This seizure will threaten the unprepared with loss of all debt secured assets in addition to all currency denominated assets

Real money is the only secure storage for value.

Don’t believe me? Listen to Mike Maloney explains the same process. Mike does a great job of explaining the architecture of the Currency system. The bottom line is that real money and real assets is the only safe store of value. His analysis endorses the gaming strategy laid out herein.

If you want a scholarly version – Mike did a great job of laying out education:

- https://goldsilver.com/hidden-secrets/episode-1/

- https://goldsilver.com/hidden-secrets/episode-2/

- https://goldsilver.com

Part 4 – Play to Win

This is a short and simple explanation of how to flip the rig to win. Simple instructions make it so that your current property, and likely much more benefit you when the music stops.

Part 5 – The Government hits the fan

Money is the essential contract between a government. Reliable money is the foundation of trade and the essential cornerstone of a thriving economy.

Government bureaucrats, at the behest of sleaze-ball bankers, always game money to steal from the people. The recipe is a two-step bait and switch. First, they morph tangible money into intangible currency second they exploit the intangible nature of currency by creating a near-infinite amount, to abscond/steal everything they can.

Once people realize they’ve been screwed the jig is up – and the government hits the fan, sometimes even including a handful of bureaucrats dangling from lamp-posts.

The US Constitution has a provision to prevent the game assigned Congress the duty to coin money:

US Constitution

The provision explicitly assigned Congress the right and responsibility to coin money. Inclusion of this in the corpus of the Constitution clearly asserts the Founding Fathers meant this responsibility permanently and forever the job of Congress, as the duly elected representatives of the people.

Part 6 – Hey, Let’s Nuke the US Economy tonight

In 1971 Saudi Arabia agreed to only accept US Dollars for payment for oil. This move established the Petrodollar as the world reserve currency. On January 19, 2023, Saudi Arabia abdicated the requirement for US Dollars to pay for oil. This broke the petrodollar. Since then, interest rate hikes have cut the value of treasures to about half.

Imagine if all the BRICS nations decided to dump US assets at the same time. For scope, there are about 7.2 trillion US treasuries outstanding. Every western bank worldwide holds US Treasuries as the most secure asset, tier-1. This dump would make every bank holding those treasuries insolvent. The value of the dollar would plummet, markets would crash and the US economy would seize.

Now let’s assume NATO is belligerent (US and allies) are posturing for war. Wouldn’t it be fun to lock down the enemy, NATO allies, and economies without firing a shot?

It seems to me that the BRICS nations have the motive and means to sink the NATO economies anytime they want.

But when?

This video is the President of Kenya warning financial system workers to abdicate the US Dollar as soon as possible. The end date “in a couple of weeks” is Easter Monday, April 10, 2023.

“For the people who work numbers, I am giving you free advice, those who are holding dollars, you might soon go into losses. Do what you must do because this market is going to be different in a couple of weeks.”

In a nutshell:

- Approximately 100 countries have significant reserves in treasuries accumulated over the years;

- The US has weaponized the dollar and alienated many of these countries;

- The US military’s Afghanistan withdrawal, vaccine mandates, and LGBTQ wokeism have degraded the world’s respect for the US military – The US Military used to defend the dollar – now it’s a joke;

- The Gold-Backed yuan is positioned as the new world reserve currency due to China’s industrial prevalence and gold reserves.

Tactically speaking – if the BRICS nations were to simultaneously dump their US treasuries – it would destroy the US dollar and paralyze the US economy overnight. This act is referred to as project Sandman.

This act is very relevant given the recent accumulation of about 300,000 NATO troops near the Russia Border.

Sources:

- Kenya President says exit US Dollar – it will change a lot in about 2 weeks, Easter Sunday/Monday 2023: https://t.me/stewpeters/21737

- Functional Interpretation: https://www.brighteon.com/bed54955-7270-48e9-8235-5d641d863ad4

- Petrodollar Switch Explained: https://www.youtube.com/watch?v=lP1L4CJ67oo

- Project Sandman Interview with Andy Schectman: https://rumble.com/v2f3m2a-operation-sandman.html

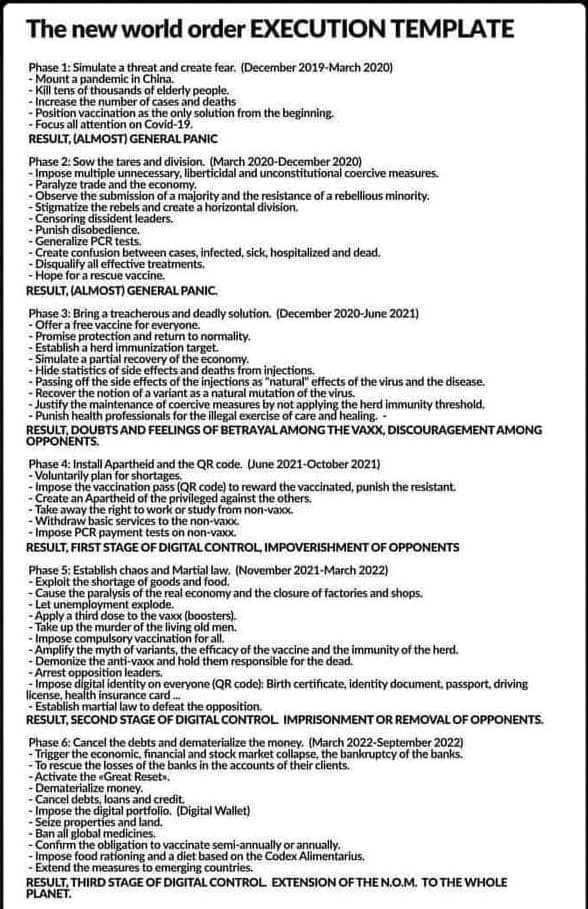

Part of the Plan – Phase 6 – New World Order Execution Template

Unless you have been under a rock for the past 5 years, you’ve heard the phrase “Great Reset”. The Great Reset is the rollout plan for the New World Order.

This document was first disclosed by Michael Yeadon, a former Pfizer executive, in 2019.

If you are wondering if it’s real – compare phases 1-5 to the events since 2019. If you’re wondering what is to come read Phase 6.

In a nutshell, the pandemic is an ongoing sophisticated social engineering program featuring massive wealth transfer and population reduction. Sinister.

There are critical failures:

- About 85% of the US population rejects vaccinations as dangerous and ineffective;

- The credibility of medical institutions and education has collapsed;

- There is a mass renaissance of natural and energetic health technology emerging as people flee Rockefeller’s medical system;

- Mass rejection of World Economic Forum

- Eat-ze-bugs is gross and offensive;

- You will own nothing and be happy…

The plan isn’t going well and the Great Reset looks more like a Great Awakening where people have become grudgingly aware that

The chart to the right shows the Great Reset Plan eliminates of 5 out of 6 people from the United States by 2025. It was published by the US Department of Defense.

The paved road back

This is a long presentation so here are the parts you will want to visit because they contain very significant moments in modern history. You may want to pour a drink before you start – but each event is confirmed.

A few critical moments to get you started with the Epstein dossier rollout:

14:05 – Mainstream News confirms Senator John McCain was put to death

18:10 – Saudi Cleanup

22:48 – Trump in Sword Dance (King of SA)

26:00 – Israel

28:30 – Varican (Exchequer of the World – FED)

33:50 – Rotchild / Banking system vs JFK

39:00 – WE ARE HERE TODAY

41:27 – Buckingham Palace

47:45 – Putin & (Soccer Ball Handoff)

51:50 – China & Forbidden City Tour

1:00:24 – Brussels – NATO & EU Parliament (Anxiety / Wait / Dossiers – mass capitulation)

1:04:53 – Muhammad Bin Salman – attack in Vegas (MBS goes active in USA re Big Tech)

1:08:00 – SA Checkin – ongoing cooperation

1:09:00 – Party in Davos with the WEF – Trump Admin is a temporary phenomenon

Part 7 – The Journey to Hell

There is a road back but the first part is going to be pretty bumpy. A century of traitors…

In 1913 Congress subrogated Constitutional responsibility administration of the value of money to a group of sleaze-bag private bankers by passing the Federal Reserve Act which transferred the sacred power of money to the Federal Reserve.

The scenario that followed rendered the US Government nominally equivalent to The Three Stooges, eventually culminating in the shit show we are living in now:

Larry is the Legislative branch that gave sacred authority to coin money to a bunch of sleazy bankers;

Curly is the sleaze-fucker Supreme Court bribed by sleazy bankers to find it constitutional for Congress to subrogate the coinage of money thus violating the cornerstone of the Constitution which assures a sound economy based on honest trade; and

Moe the Executive branch that eventually, in 1973, reneged on government duty to stand behind the value of its money by reneging on the obligation to assure money’s value gold and silver.

Shit show Chapters:

- After people realize that the government reneged on the social contract money;

- They realize nearly everything they thought they had was stolen;

- Economic chaos ensues All public obligations (contracts) fail, Social Security, Pensions, Bonds, Stocks, and even the money itself are worthless as the government officials responsible for assuring integrity helped steal the value of everything;

- Private obligations dependent on public obligations fail as a consequence of force-majeure;

- The people wake up with their asses really sore wondering what-the-fuck happened – many die;

- Those who survive are mad as fuck;

- Government fails from top to bottom as remaining bureaucrats stuck holding the bag become concerned that the lamp posts outside their offices will find a new use related to the final moments of their earthly journey;

- Eventually, the people unwind the problem and go back to real money;

- Recovery begins.

The shit show goes on until the populace is either dead or badly fucked and angry enough to return to an accountable institutional behavior. Another time, I’ll go into why legacy governance structures are obsolete. In the meantime this video suggests how the dominoes will fall:

Part 6 – The Math of Theft by Inflation

This section illustrates the factual basis for the Play to Win rules.

Congress and the Federal Reserve have progressively moved the United States from a money-based economy to a currency-based economy since this began the value ratio of money to currency versus has deteriorated by 1000:1, at the time of this analysis, with much more to go.

Realized versus Baked-in inflation:

- Realized Inflation – affects the current prices. It includes active currency competing goods and services thus causing current prices.

- Baked-In Inflation affects future prices but not current prices yet. Siloed currency causes future inflation when it is spent on goods and services.

Generally realized inflation pulls warehoused money into circulation as holders spend siloed funds to compete for the existing goods and services. For example, the 5:1 increase in currency in 2020 is will be realized when the siloed money is spent on something thus drawn into circulation.

Recent Comments