Play the Manipulation Plan:

| Action | Strike | % of Trade Capital | Condition 1 | Condition 2 | Entry ~Time | Exit ~Time | Yield Fantasy | % probability of loss | |

|---|---|---|---|---|---|---|---|---|---|

| MSFT | Buy Call Exp 6/19 | ~10% Above the Money | 10% | US10Y Stable or Rising | SPX Stable for 1h | 12:30 p to 1:45 p Fri Jun 12 | 12:30 p to 1:45 p Tue Jun 16 | 10x | 25% |

| XLF | Buy Call Exp 6/19 | same | same | same | same | same | same | 15x | 25% |

| AG | Buy Call Exp 6/19 | same | same | same | same | same | same | 0-15x | 35% see Ag note |

Predicted Scenario

- The FOMC announcements (Last Wednesday) results in a sharp drop starting 1 days prior to Powell speaks. Incomprehensible incompetence triggers loss of confidence. Which tends to end about 2 days later, usually Friday. This triggers 2 sell waves in addition to the organic weekend-exit wave.

- Sell Wave-1: Thurs observed a 5.8% drop in S&P as SPX – Incompetence Spook phase.

- Sell Wave-2: Margin calls trigger to and cause a 2nd sell wave which peaks Friday AM.

- Sell Wave-3 Drop spooks traders who won’t hold over a weekend.

- Selling triggers strong anti-drop engagement by PPT.

- Weak hands all flushed. The stunned and afraid are all out.

- Bottom on Friday afternoon when the FED starts buying 10Y debt & yield stabilizes. Why? Stabilized Yield halts the stock-price decline. No particular effect on stocks yet – but selling stops & floor is set.

- This is the buy-signal – but only on stable 10Y Yield.

- Weekend. Fed prints a shit-ton of $ and Plunge Protection Team kicks into high gear late Friday Afternoon across all exchanges. Stealth stabilizes price and prices gently increase. Mon AM – watch NIKKEI, HANG SENG, FTSE 100 & DAX as time-machine that generally leads NYSE. Up is good.

- Monday-shock Fed riggers pump $$$. Watch NFLX, (lowest cap FANG), for rise. Usually for gap-up, which tells SPX higher as FED-net buys aggressively.

- Monday PM. The world hasn’t ended. Buying ramps.

- Tues AM. Greed kicks in.

- Exit calls Tues PM, Hold on release of news good (China Deal & other BS) Exit on drop in 10Y yield drop EU & Asia indexes.

- Downside: 30% max loss

- Upside-10x to 1 trade yield.

- Estimated Success Probability ~60%

Selection Criteria

Selection Basis. These picks are based essential need of the FED to avoid a massive system crash due to banking system failure multiplied by the 3 wave dip-leverage.

They exploit reverse-risk-leverage. The FED is terrified of massive system failure – and sign weakness in the banks will trigger the big one. They have nothing to do with quality of the underlying stocks – only the urgent need of the FED to avoid any sign of weakness.

AG: Yield on AG heavily dependent on real Ag (NOT AG) market. Very amplified leverage driven by emergent fear of COMEX silver short delivery failure. No apparent stress on these due to threatened prosecution of JPM for RICO. News of RICO action will amplify this yield. Fear operators: If silver blows BlackRock, JPM, Citibank, BOA fail. Double Down on JPM Prosecution news.

XLF: Low interest rates are normally death for banks. The banking sector is ridiculously propped up. The FED dumps Massive $$$ into banks to inhibit awareness that they are walking dead. XLF is massively leveraged and the FED cannot allow any perception of weakness in the banking sector which would prompt fear of credit freeze & massive crash. Fear Factor: Banks in general. Linked to Society Generale, JPM, Citibank, BOA…

MSFT Selection: Bastard sibling of the FANG stocks. More leverage than actual FANG stocks due to lower price, but moves in tandem. Higher yield on options than with FANG sticks. Fear Factor: FED must protect face by propping up tech sector, aka FANG, else exposure of mass systemic failure.

Influences:

- Greggory Mannarino

- Road to Roota

- Gerald Celente

- Federal Reserve Channel

- The Plunge Protection is Real

- qmap.pub – Political instability indicator – Bad news reinforces need to prop up markets & causes tradeable over-correction spikes.

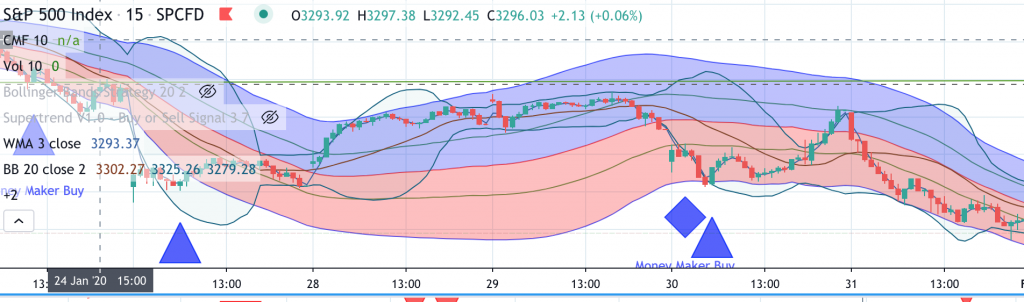

Jan 28-29

March 3

March 15

April 28-29

- Sharp drop at meeting announcement

- Bottom same day

- Pushed back to baseline

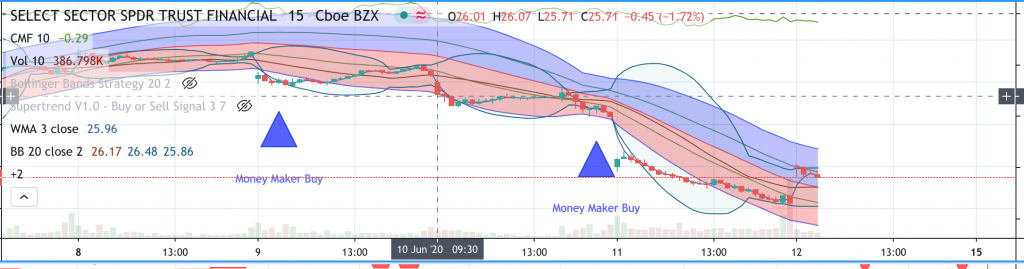

June 9-10

- Market anticipates negative rate announcement

- Financial stocks sell off

- Expect FED to support

- Reserve requirements abandoned

- Massive non-payment of mortgages, car loans and credit cards

July 28-29

Sept 15-16

Execution

Entered XLF & AG Fri AM during Fed Pump. Overpaid. Should have let the pump wave pass & bought in later in day during dip.

Sat Update – Alt News cycle starts to echo 2Q instability in Banking Sector. Predicted Fed response is to inflate Bank Stocks to project stability. Repos go to 4.3T to keep banks in business. Only choice appears to be to pump $$ into banks. Fed has $700B in rainy day funds to use in next 2 weeks. [Prop up the banks?]

Sources:

Strategy is to hold XLF pending Mon/Tues liquidity pump to lift Banks, etc. Normally these events would push market down, but will be used as cover to push insane amounts of liquidity into banks, $700B. I predict this will appear as a large boost to equity prices in the financial sector.

Hold AG. The boost to Banks will enable partial liquidation SLV shorts. This will enable SLV to rise, and Ag likely to react to normal buying from safe-asset buyers. Price likely to rise Wed/Thur next. Planned Thurs afternoon per recurring Thursday afternoon Silver Smackdown.

Note how the China Trade Deal was Floated again:

Recent Comments